update on irs unemployment tax refund

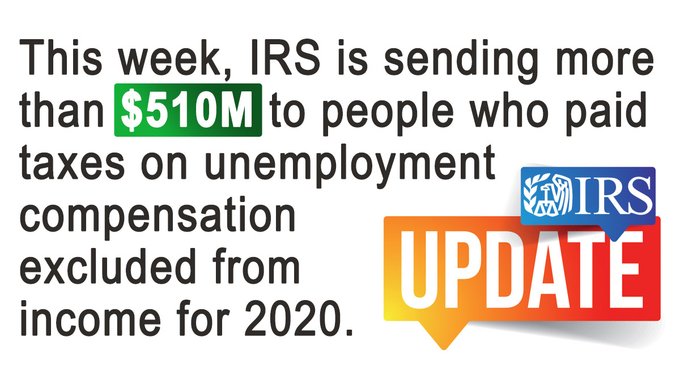

WASHINGTON The Internal Revenue Service recently sent approximately 430000 refunds totaling more than 510 million to taxpayers who paid taxes on unemployment compensation excluded from income for tax year 2020. The transcript shows a refund of 176214.

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says

22 2022 Published 742 am.

. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. Billion for tax year 2020. Some people received direct deposits from IRS TREAS 310 as part of 28 million refunds IRS sent this week to taxpayers due money for taxes on unemployment in 2020.

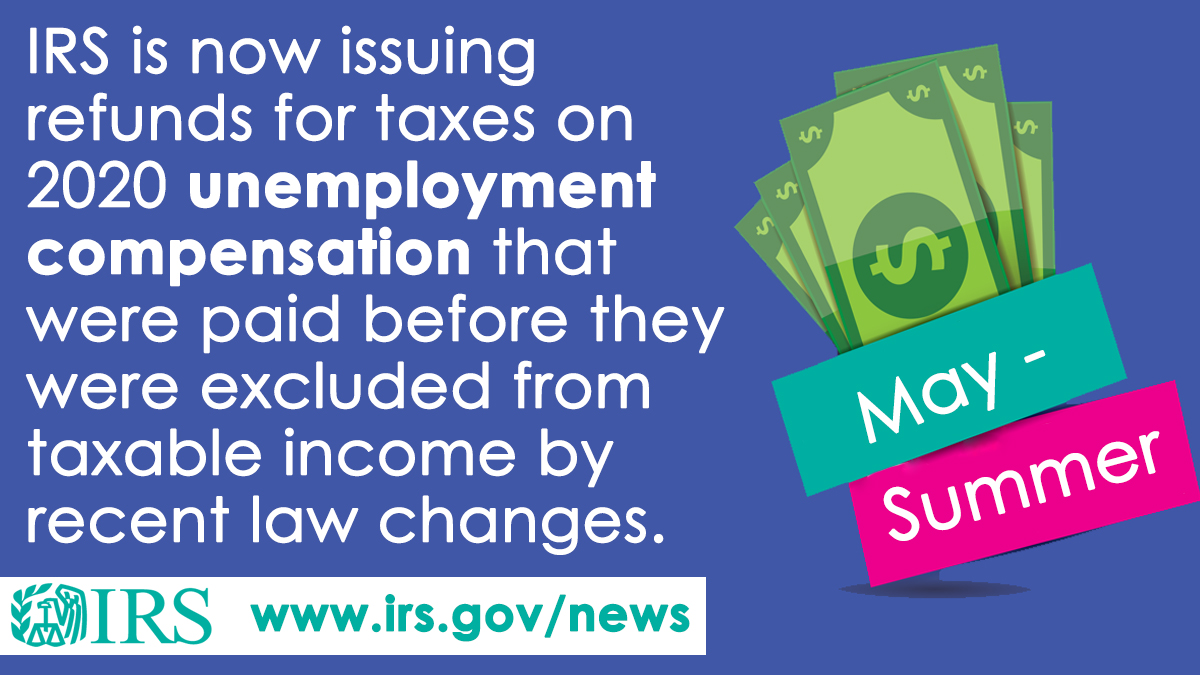

The American Rescue Plan Act allows eligible taxpayers to exclude up to 10200 up to 10200 for each. In most cases if you already filed a 2020 tax return that includes the full amount of your unemployment compensation the IRS will. Current refund estimates are indicating that for single taxpayers who qualify for the.

Will I receive a 10200 refund. Any overpayment will be refunded by the IRS. The internal revenue service doesnt have a separate portal for checking the unemployment compensation tax refunds.

COVID Tax Tip 2021-87 June 17 2021. IR-2021-212 November 1 2021. 4th STIMULUS CHECK.

Updated March 23 2022 A1. On Nov 1 the IRS announced that it had issued approximately 430000 tax refunds to taxpayers who overpaid taxes on their unemployment benefits in 2020. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. Already filed a tax year 2020 tax return.

My transcript finally updated with a 728 deposit date but I received the refund yesterday. The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year.

Some people received direct deposits from IRS TREAS 310 as part of 28 million refunds IRS sent this week to taxpayers due money for taxes on unemployment in 2020. The agency had sent more than 117 million refunds worth 144. Irs unemployment tax refund august update.

If you filed your taxes before the new law went into effect dont worry. The IRS has issued more than 117 million special unemployment benefit tax refunds totaling 144. Yes Fourth Stimulus Check Update Irs Tax Refunds 10 200 Unemployment In 2021 Tax Refund Irs Taxes Checks Tax Day Deadline In 3 Weeks What Happens If You File A Tax.

1 the IRS has now issued more than 117 million unemployment compensation refunds. You do not need to. The most recent batch of unemployment refunds.

In the latest batch of refunds announced in November however. These updated FAQs were released to the public in Fact Sheet 2022-21 PDF March 23 2022. Unemployment tax refund less than transcript says.

By Anuradha Garg. 10200 IRS UNEMPLOYMENT TAX refund update. IR-2021-159 July 28 2021.

Irs Sends 430000 Additional Tax Refunds Over Unemployment Benefits. IRS schedule for unemployment tax refunds With the latest batch of payments on Nov. Unemployment benefits are generally treated as taxable income according to the IRS.

The IRS will determine the correct taxable amount of unemployment compensation and tax. You have an adjustment because of the exclusion that will result in an increase in. The IRS started sending refunds to taxpayers who received jobless benefits last year and paid.

This refund may also be applied to other taxes owed. In the case of married individuals filing a joint Form 1040 or 1040-SR this exclusion is up to 10200 per spouse. The IRS has identified 16 million people to date who may qualify for an associated tax refund or other benefit.

Irs Is Mailing Refunds To Some Taxpayers Who Claimed Unemployment Verifythis Com

Descubre Los Videos Populares De Who Has Received Unemployment Tax Refund Tiktok

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

When Will Irs Send Unemployment Tax Refunds In June How Many People Are Receiving Them As Usa

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

Tax Refunds 2022 Why Did You Only Get Half Of Your Tax Return Marca

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com

Interesting Update On The Unemployment Refund R Irs

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Unemployment Tax Break Refund How To Check Your Irs Transcript For Clues

Irs Sends First Unemployment Tax Refunds But Automatic State Refunds Are In Limbo Mlive Com

Unemployment Tax Refund Update What Is Irs Treas 310 13newsnow Com

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Irs Refund 4 Million Tax Refunds For Unemployment Compensation Marca

Irsnews On Twitter Irs Is Issuing Refunds For Taxes Paid On 2020 Unemployment Compensation Excluded From Income The First Adjustments Are For Single Taxpayers Who Had The Simplest Tax Returns Details At